AD-AS model

The AD-AS or Aggregate Demand-Aggregate Supply model is a macroeconomic model that explains price level and output through the relationship of aggregate demand and aggregate supply. It is based on the theory of John Maynard Keynes presented in his work The General Theory of Employment, Interest, and Money. It is one of the primary simplified representations in the modern field of macroeconomics, and is used by a broad array of economists, from libertarian, Monetarist supporters of laissez-faire, such as Milton Friedman to Post-Keynesian supporters of economic interventionism, such as Joan Robinson.

The conventional "aggregate supply and demand" model is, in actuality, a Keynesian visualization that has come to be a widely accepted image of the theory. The Classical supply and demand model, which is largely based on Say's Law, or that supply creates its own demand, depicts the aggregate supply curve as being vertical at all times (not just in the long-run)

Contents |

Modeling

The AD/AS model is used to illustrate the Keynesian model of the business cycle. Movements of the two curves can be used to predict the effects that various exogenous events will have on two variables: real GDP and the price level. Furthermore, the model can be incorporated as a component in any of a variety of dynamic models (models of how variables like the price level and others evolve over time). The AD-AS model can be related to the Phillips curve model of wage or price inflation and unemployment.

Aggregate demand curve

The AD curve is defined by the IS-LM equilibrium income at different potential price levels. The Aggregate demand curve AD, which is downward sloping, is derived from the IS – LM model.

It shows the combinations of the price level and level of the output at which the goods and assets markets are simultaneously in equilibrium. The above figure showing IS and LM curves, where LM curve shifts downward to the right to LM’ and thus shifting the new equilibrium to E’ where both goods and money market gets cleared. Now, the new output level Y’ correspond to the lower price level P’. Thus a reduction in price, which is shown in the figure, leads to an increase in the equilibrium and spending.

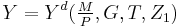

The equation for the AD curve in general terms is:

where Y is real GDP, M is the nominal money supply, G is real government spending, T is an exogenous component of real taxes levied, P is the price level, and Z1 is a vector of other exogenous variables that affect the location of the IS curve (exogenous influences on any component of spending) or the LM curve (exogenous influences on money demand). The real money supply has a positive effect on aggregate demand, as does real government spending (meaning that when the independent variable changes in one direction, aggregate demand changes in the same direction); the exogenous component of taxes has a negative effect on it.

Slope of AD curve

The slope of AD curve reflects the extent to which the real balances change the equilibrium level of spending, taking both assets and goods markets into consideration. An increase in real balances will lead to a larger increase in equilibrium income and spending, the smaller the interest responsiveness of money demand and the higher the interest responsiveness of investment demand. An increase in real balances leads to a larger level of income and spending, the larger the value of multiplier and the smaller the income response of money demand.

This implies that: The AD curve is flatter, smaller is the interest responsiveness of the demand for money and larger is the interest responsiveness of investment demand. Also, the AD curve is flatter, the larger is the multiplier and the smaller the income responsiveness of the demand for money.

Effect of Monetary Expansion on the AD curve

An increase in the nominal money stock leads to a higher real money stock at each level of prices. In the asset market, the decrease in interest rates induces the public to hold higher real balances. It stimulates the aggregate demand and thereby increases the equilibrium level of income and spending.Thus, as we can see from the diagram, the aggregate demand curve shifts rightward in case of a monetary expansion.

Aggregate supply curve

The aggregate supply curve may reflect either labor market disequilibrium or labor market equilibrium. In either case, it shows how much output is supplied by firms at various potential price levels. The Aggregate supply curve (AS curve) describes for each given price level, the quantity of output the firms are willing to supply.

The Keynesian case shows that the AS curve is horizontal implying that the firm will supply whatever amount of goods is demanded at a particular price level. The idea behind that is because there is unemployment; the firms can get as much labour as they want at that current wage. Their average costs of production therefore are assumed not to change as their output level change. They are thus willing to supply as much as is demanded at the existing price level.

The Classical Supply Curve is based on the assumption that the labour market is always in equilibrium with the full employment of the labour force. If the entire labour force is being employed, then output can’t be raised even if the price rises as there is no extra labour force for extra output. Thus, the AS curve will be vertical at the level of output corresponding to the full employment of the labour force.

Fiscal and monetary policy under Classical and Keynesian cases

Keynesian Case: If there is a fiscal expansion i.e. there is an increase in the government spending or a cut in the taxes, it will shift the AD curve rightwards. The shift would then imply an increase in the equilibrium output and employment.

In the Classical case, the AS curve is vertical at the full employment level of output. Firms will supply the equilibrium level of output whatever the price level maybe.

Now, the fiscal expansion shifts the AD curve rightwards, thus leading to an increase in the demand for goods, but the firms cannot increase the output as there is no labour force which can be obtained. As firms try to hire more labour, they bid up wages and their costs of production and thus they charge higher prices for the output. The increase in prices reduces the real money stock and leads to an increase in the interest rates and reduction in spending.

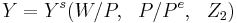

The equation for the aggregate supply curve in general terms for the case of excess supply in the labor market, called the short-run aggregate supply curve, is

where W is the nominal wage rate (exogenous due to stickiness in the short run), Pe is the anticipated (expected) price level, and Z2 is a vector of exogenous variables that can affect the position of the labor demand curve (the capital stock or the current state of technological knowledge). The real wage has a negative effect on firms' employment of labor and hence on aggregate supply. The price level relative to its expected level has a positive effect on aggregate supply because of firms' mistakes in production plans due to mis-predictions of prices.

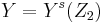

The long-run aggregate supply curve refers not to a time frame in which the capital stock is free to be set optimally (as would be the terminology in the micro-economic theory of the firm), but rather to a time frame in which wages are free to adjust in order to equilibrate the labor market and in which price anticipations are accurate. In this case the nominal wage rate is endogenous and so does not appear as an independent variable in the aggregate supply equation. The long-run aggregate supply equation is simply

and is vertical at the full-employment level of output. In this long-run case, Z2 also includes factors affecting the position of the labor supply curve (such as population), since in labor market equilibrium the location of labor supply affects the labor market outcome.

Shifts of aggregate demand and aggregate supply

The following summarizes the exogenous events that could shift the aggregate supply or aggregate demand curve to the right. Of course, exogenous events happening in the opposite direction would shift the relevant curve in the opposite direction.

Shifts of aggregate demand

The following exogenous events would shift the aggregate demand curve to the right. As a result, the price level would go up. In addition if the time frame of analysis is the short run, so the aggregate supply curve is upward sloping rather than vertical, real output would go up; but in the long run with aggregate supply vertical at full employment, real output would remain unchanged.

Aggregate demand shifts emanating from the IS curve:

- An exogenous increase in consumer spending

- An exogenous increase in investment spending on physical capital

- An exogenous increase in intended inventory investment

- An exogenous increase in government spending on goods and services

- An exogenous increase in transfer payments from the government to the people

- An exogenous decrease in taxes levied

- An exogenous increase in purchases of the country's exports by people in other countries

- An exogenous decrease in imports from other countries

Aggregate demand shifts emanating from the LM curve:

- An exogenous increase in the nominal money supply

- An exogenous decrease in the demand for money (in liquidity preference)

Shifts of aggregate supply

The following exogenous events would shift the short-run aggregate supply curve to the right. As a result, the price level would drop and real GDP would increase.

- An exogenous decrease in the wage rate

- An increase in the physical capital stock

- Technological progress — improvements in our knowledge of how to transform capital and labor into output

The following events would shift the long-run aggregate supply curve to the right:

- An increase in population

- An increase in the physical capital stock

- Technological progress

Monetarism

The modern quantity theory states that the price level is proportional to the quantity of money. Only a few believe this as it is an old concept. Friedman is the recognized intellectual leader of an influential group of economists, called, Monetarists, who emphasize the role of money and monetary policy in affecting the behaviour of output and prices. Modern quantity theory also disagrees with the strict quantity theory in not believing that the supply curve is vertical in the short run. Thus, Friedman and other monetarists made an important distinction between the short run and long run effects of changes in money. They said that in the long run money is more or less neutral. Changes in real money stock have no real effects and only change prices. But in the short run, they argue that the monetary policy and changes in the money stock can have important real effects.

See also

External links

- Sparknotes: Aggregate Supply and Aggregate Demand brief explanation of the AD-AS model

- "Aggregate Demand and Aggregate Supply" in CyberEconomics by Robert Schenk explains the AD-AS model and explains its relation to the IS/LM model

- "ThinkEconomics: Macroeconomic Phenomena in the AD/AS Model" includes an interactive graph demonstrating inflationary changes in a graph based on the AD-AS model

- "ThinkEconomics: The Aggregate Demand and Aggregate Supply Model" includes an interactive AD-AS graph that tests one's knowledge of how the AD and AS curves shift under different conditions

References

- Mankiw N.Gregory(2008),Worth Publishers,New York

- Olivier Blanchard,Fourth Edition,Pearson Education Inc.

Scholarly articles

- Dutt, Amitava K.and Skott, Peter. "Keynesian Theory and the AD-AS Framework: A Reconsideration," Working Papers 2005-11, University of Massachusetts Amherst, Department of Economics. 2005.

- Palley, Thomas I. "Keynesian theory and AS/AD analysis". Eastern Economic Journal, Fall 1997.

- Amitava Krishna Dutt and Skott, Peter. "Keynesian Theory and the Aggregate-Supply/Aggregate-Demand Framework: A Defense," Eastern Economic Journal, Eastern Economic Association, vol. 22(3), pages 313-331, Summer 1996.